Environmental Liability Insurance is a specialized policy designed to protect businesses from the financial consequences of environmental contamination, pollution claims, and regulatory enforcement. As environmental laws in Canada become more stringent, companies handling potential contaminants—from hazardous chemicals to everyday substances like oil, salt, and wastewater—face increased liability risks.

Without sufficient coverage, your business may risk facing significant financial burdens associated with environmental incidents. If you are found responsible for cleanup and remediation costs that arise from your spills or contamination events, this could potentially lead to hefty financial losses.

Additionally, neighbouring businesses, municipalities, or property owners could file third-party claims, further complicating matters. Moreover, businesses might incur substantial legal defense fees and regulatory fines as a consequence of non-compliance with environmental laws and regulations.

Ferrari & Associates recognizes the complexities of navigating regulatory compliance while maintaining operational efficiency and ensuring financial stability. If your business stores, transports or handles materials that could have a hazardous impact on land, air or water, then you need to talk to our team about Environmental Liability Insurance.

Our Environmental Liability Insurance solutions are specifically designed to cover businesses within manufacturing, construction, real estate, energy, transportation and logistics, and other sectors against unforeseen environmental challenges.

Canada’s environmental laws are evolving rapidly, leading governments to impose stricter penalties for pollution, spills, and contamination. Fines, lawsuits, and mandatory cleanup costs can severely impact businesses that lack proper insurance.

For example: A contractor was held liable for soil contamination due to improper waste disposal at a job site. The cleanup costs exceeded $750,000, but their Environmental Liability Insurance covered remediation expenses, legal fees, and settlement costs.

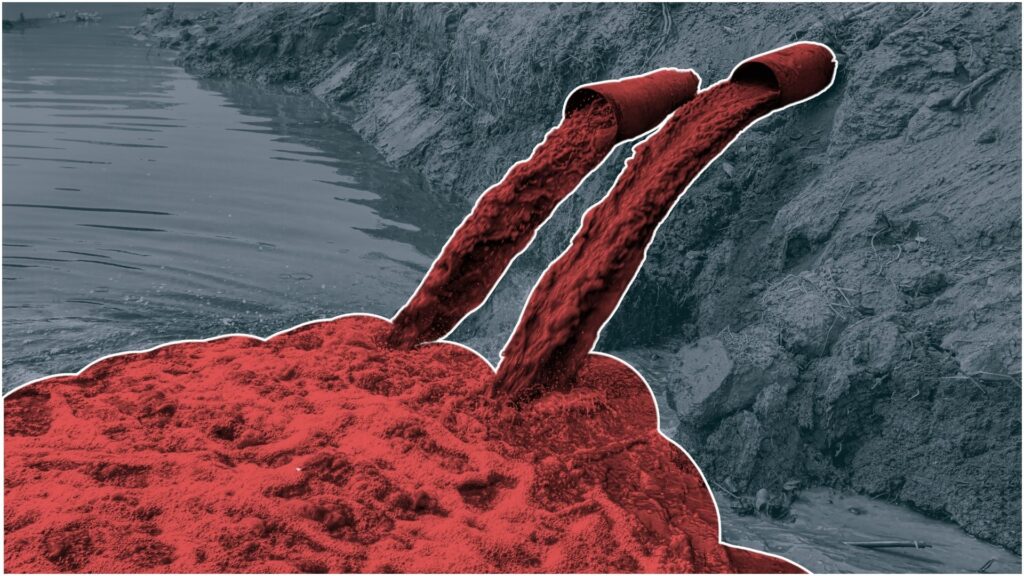

Many businesses underestimate their exposure to environmental risks, assuming that only toxic chemical spills trigger liability. However, even common substances—such as oil, gas, salt, and wastewater—can cause environmental harm, leading to costly claims and regulatory action.

For example: A transportation company experienced an accidental diesel spill, contaminating a nearby stream. Without insurance, they would have faced six-figure cleanup costs and legal action from environmental authorities.

An environmental incident can cause severe reputational damage, leading to loss of business, lawsuits, and regulatory shutdowns. Having a comprehensive Environmental Liability policy ensures that your business remains financially stable and operational even in the face of an unforeseen environmental event.

For example: A property developer unknowingly purchased land with pre-existing soil contamination from an old industrial site. After facing cleanup orders from the government, their Real Estate Environmental Liability policy covered remediation costs and legal fees, preserving the company’s financial health.